Vulnerability management for insurance

Secure client confidence with penetration testing for the insurance industry

Protecting sensitive customer data, ensuring operational continuity, and maintaining the trust of policyholders are critical challenges for the insurance industry. Penetration testing provides insurance firms, brokers and underwriters with essential protection, exposing vulnerabilities and fortifying defenses against cyber threats.

Join 1,000+ leading companies who trust Rootshell Security

Highly experienced team of cyber security professionals

Our extensive experience in the insurance industry means we’re well-versed in the regulatory landscape, with accreditations including GDPR, ISO 27001, and PCI DSS. Our insurance penetration testing services are designed specifically to support safeguarding massive amounts of sensitive customer data and complying with strict regulatory frameworks.

Tailored approach to cyber resilience

From external threats like phishing attacks to internal vulnerabilities within your network, our services provide full-spectrum protection bespoke to your requirements. We also offer comprehensive attack surface management services that give you real-time visibility into your infrastructure, enabling you to strengthen weak points before they become a threat.

Identify vulnerabilities, protect your brand reputation

A single breach can damage your reputation beyond repair, leading to customer churn and financial loss. Our penetration testing services help you proactively protect your brand’s reputation by identifying vulnerabilities before cybercriminals do.

Why insurance professionals choose Rootshell

With Rootshell

- Detect threats before they become bigger issues

- Support from a team of insurance penetration testing experts

- Improved customer trust

- Reporting format with compliance in mind

- 12-month tailored penetration testing package

Without Rootshell

- Hidden threats

- Manual reporting and scanning

- Higher risk of reputational damage

- Lack of customer confidence

- Non-compliance risks

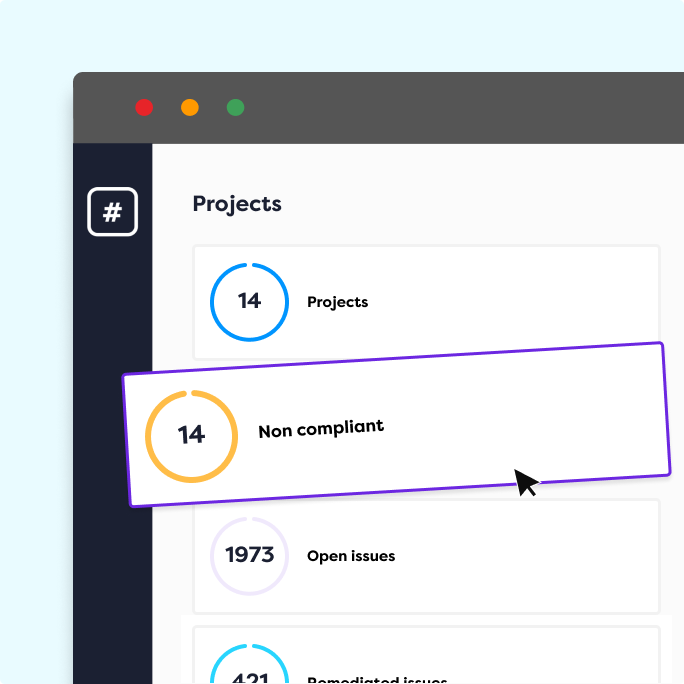

Manage all your vulnerabilities in one platform

The Rootshell Platform brings together all of your cyber assessment reporting into a single platform to make vulnerability management more efficient than ever before.

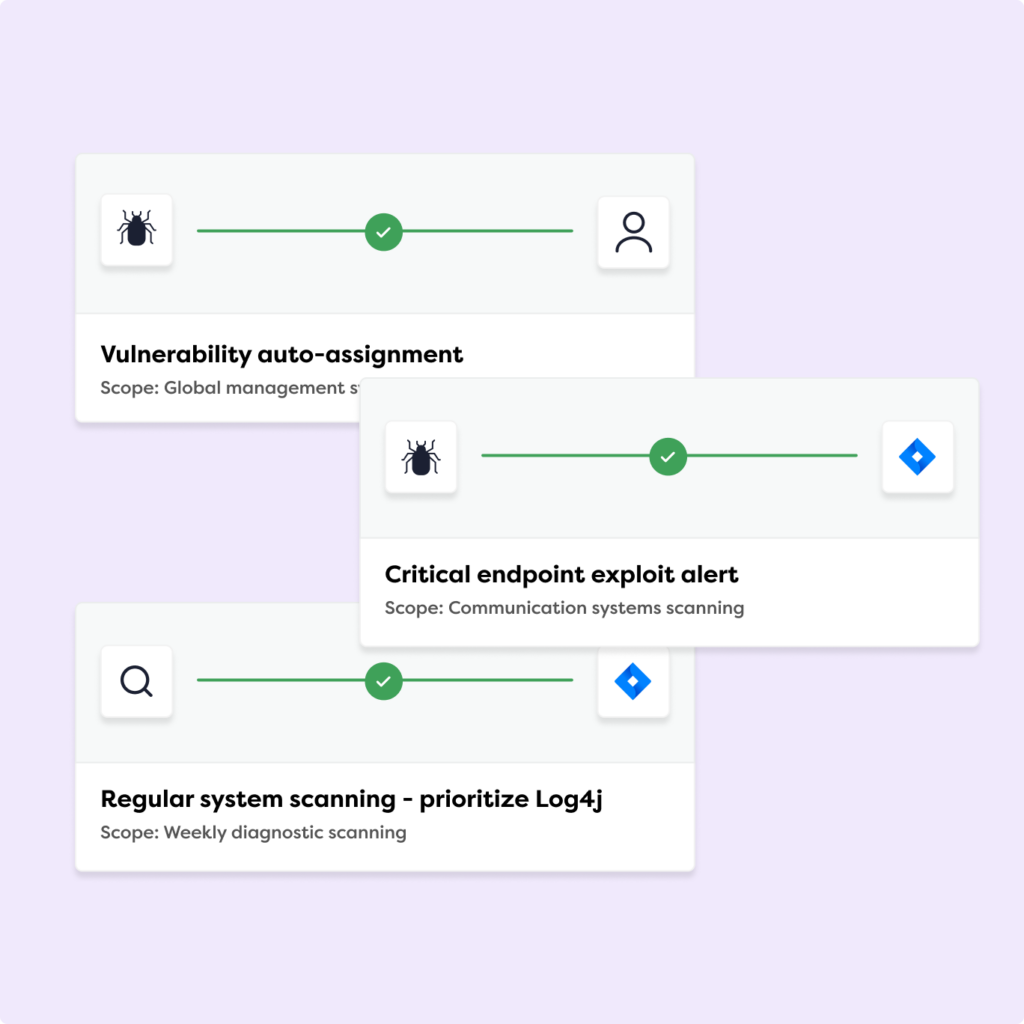

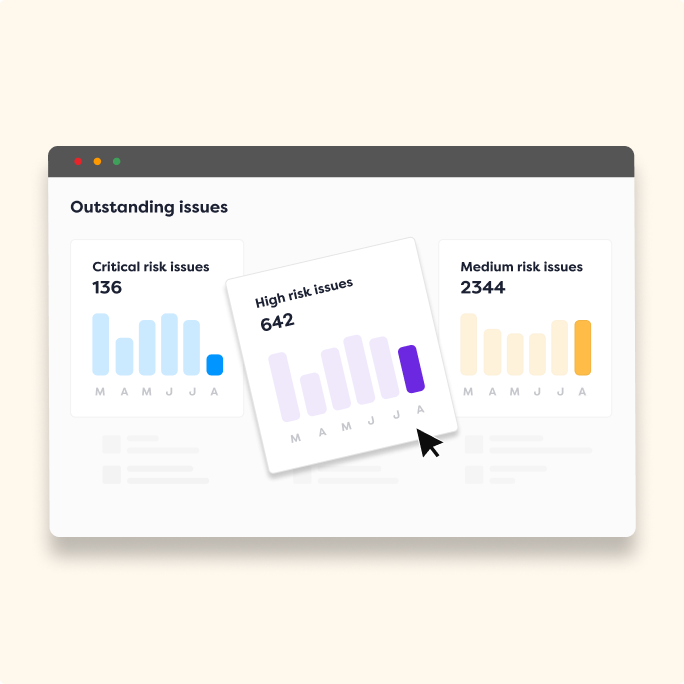

Detect vulnerabilities in real time

Our AI-powered exploit protection tool continuously monitors your attack surface. If a vulnerability is detected, you’ll receive an instant notification.

Make better decisions with consolidated data

Our platform consolidates data from any scanner or penetration testing vendor into one comprehensive database, automatically priotizing issues by criticality.

Track and manage remediation efforts

The Rootshell Platform tracks your remediation progress, measuring your performance against service level agreements (SLAs) and can even mark issues as remediated on your behalf to save time.

Don’t just take our word for it, hear from our

clients...

Ready to get started?

1

Discover your needs

2

Dive into a personalized demo

3

Seamless onboarding

Discover your needs

Dive into a personalized demo

Seamless onboarding

Stories of success from other transport &

logistics companies

Frequently asked questions & answers

Can’t find the answer to your question?

You can always Contact Our Team of experts for a chat!

Why is penetration testing important for insurance companies?

Cybercriminals target the insurance industry’s data-rich environments. Penetration testing helps identify vulnerabilities before they can be exploited, ensuring that customer data remains protected and compliance with regulations is maintained.

How does penetration testing protect my brand's reputation?

A data breach can severely damage an insurance company’s reputation, causing customers to lose trust in your ability to protect their personal information. Penetration testing helps by identifying and fixing security gaps before they’re discovered by cybercriminals.

How does the Rootshell Platform help manage cyber threats?

The Rootshell Platform offers a centralized solution for managing vulnerabilities, with real-time scanning, consolidated data reporting, and automated remediation tracking. It integrates with any scanner or penetration testing vendor, giving you a single dashboard to monitor your cybersecurity posture. Book a demo to see it in action!

How often should insurance companies conduct penetration testing?

Insurance companies should continuously test their attack surface through a mixture of penetration testing, scanning and continuous enrichment.

What types of cyber security tests are available for insurance companies?

We offer several types of penetration testing and attack surface management services for insurance companies, including web application testing and phishing simulation. These tests help identify vulnerabilities and provide comprehensive coverage across your cyber defences.

Ready to take back

control of your cyber

security?